Sustainable Investment Management

To achieve the goal of the Paris Climate Agreement, the rapid and complete decarbonisation of the economy is a prerequisite.

Decarbonisation Strategy

The decarbonisation strategy pursues the goal of phasing out coal and oil by 2030 and natural gas and nuclear energy by 2035 at the latest and continuously reducing the emissions intensity (WACI) of investments.

UNIQA made a commitment in 2019 to gradually exclude coal from its investments. In the case of direct investments in companies, we exclude not only issuers that are active in coal mining, but also those that generate energy from coal.

Furthermore, from 2025, additional coal-related restrictions have been implemented for direct investments in coal processing and heat generation. The UNIQA Group's coal phase-out policy and the phase-out plan for other fossil fuels and nuclear energy are set out in the decarbonisation strategy.

Further information on decarbonisation in investments can be found here:

As part of our memberships in the United Nations Net-Zero Asset Owner Alliance (NZAOA) and the Austrian Green Finance Alliance (GFA), we are committed to gradually decarbonising our investment portfolio to align with the Paris 1.5-degrees Cesius climate target pathway as much as possible and to achieve net-zero emissions in our investments by 2050 across the Group.

The successful validation of our climate interim targets by the Science Based Targets initiative (SBTi) in 2023 further enhances our sustainability strategy in investments.

Further information can be found in the Science Based Targets Initiative summary.

Phase-out from coal, oil, natural gas and nuclear energy

Targeted decarbonisation, engagements, risk assessments and sustainable investments promote climate-friendly transformation and strengthen the ESG performance of the portfolio.

Further information on decarbonisation in investments can be found here:

By working with our specialised data provider ISS (Institutional Shareholder Services), we can carry out a comprehensive analysis of our investments in relation to various sustainability factors. We need this data on our investees to ensure our exclusion and phase-out strategy, which sets the following limits:

Coal

- Roll out of coal exclusion criteria since 2019.

- Since April 2022, no investments have been made in funds including companies that generate more than 10% of their revenue from thermal coal transactions.

- Since 2024, no direct investments have been made in thermal coal producers or energy suppliers that produce electricity from coal if they generate more than 5% of their revenue from coal.

Oil

- No new direct investments in the expansion of projects from 2025 onwards.

- As of 2025, no new direct investments will be made in oil producers or companies that produce heat from oil if they generate more than 30% of their revenue from oil.

- Termination of exisitng direct investments in oil producers or enterprises that produce heat from oil by 2030, if the producers or companies in question generate more than 5% of their revenues from oil.

- Exceptions are made granted for companies with SBTi certified targets in place.

Natural Gas

- No new direct investments in the expansion of projects from 2026 onwards.

- No new direct investments in companies that generate more than 30% of their revenue from the natural gas sector as of 2026.

- Termination of existing direct investments in companies that generate more than 5% of their revenue from the natural gas business by 2035.

- Exceptions have been granted for companies with SBTi certified targets in place and companies that conduct EU Taxonomy-aligned activities (revenue, CapEx, OpEx).

Nuclear Energy

- No new direct investments in the expansion of nuclear infrastructure projects from 2025 onwards.

- Termination of existing direct investments in companies that generate more than 5 per cent of their revenue from nuclear energy by 2035.

- Exceptions have been granted for companies with SBTi certified targets in place and companies that conduct EU Taxonomy-aligned activities (revenue, CapEx, OpEx).

Engagement strategy for sustainable investments

With its engagement strategy, the UNIQA Group is in direct and indirect contact with its investees through both proactive and reactive engagement. The engagements with companies are intended to improve the performance of our investees, particularly with regard to their climate strategy, decarbonisation targets and measures. Through our engagements, we focus on active dialogue to promote the idea of transition in order to prevent divestment wherever possible.

By proactive engagement, we mean our direct bilateral engagements with individual companies, with a focus on companies that together account for 65% of our financed emissions. We aim to drive these forward by 2027 through bilateral discussions with the ESG teams of the respective companies about their specific targets.

By reactive engagement, we mean collaborative engagement, which we pursue as part of our membership of the Climate Action 100+ investor initiative. This involves a group of international investors engaging with companies that are among the 170 most emissions-intensive in the world in order to harmonise their climate strategy and disclosure with science-based climate targets.

On the other hand, we have been pursuing standards-based engagement led by ISS since 2023. ISS enables investors to engage with companies that commit serious and structural violations of normative criteria in the areas of corporate governance, human and labour rights, the environment, bribery and corruption or fail to take measures to respond appropriately and take countermeasures. These include, in particular, violations of the principles of the UN Global Compact (UNGC) and the Guidelines for Multinational Enterprises of the Organisation for Economic Cooperation and Development (OECD).

As part of our engagement, we endeavour to convince our investees of the following activities:

- Implementation of a governance framework that defines responsibilities and oversight obligations for climate risks.

- Measures to reduce greenhouse gas emissions along the entire value chain in line with the Paris 1.5°C climate target pathway, as well as the setting of SBTi-validated targets, if not yet set.

- Transparent disclosure to show the resilience of the corporate strategy to various climate scenarios.

Strategy for Sustainable Investments

UNIQA finances companies that contribute to reducing emissions or to social projects. The sustainability definitions of green, social and sustainability bonds in accordance with the International Capital Market Association (ICMA) Principles are used for this purpose. In addition, funds that are categorised as Article 9 funds (dark green funds) in accordance with the EU Sustainable Finance Disclosure Regulation (SFDR) are included in sustainable investments. These represent investments that pursue a sustainability objective as defined by the SFDR. In addition, investments are made in infrastructure projects that make a positive contribution to at least one Sustainable Development Goal (SDG) without having a negative impact on other goals. The sustainable investment strategy is set out in the UNIQA Group Responsible Investment Standard. Investments made are regularly monitored by Risk Management.

Sustainable investments support adaptation to climate change, by promoting infrastructure projects in the field of renewable energy.

Sustainable investments are not analysed according to their emissions, but according to their transformation potential.

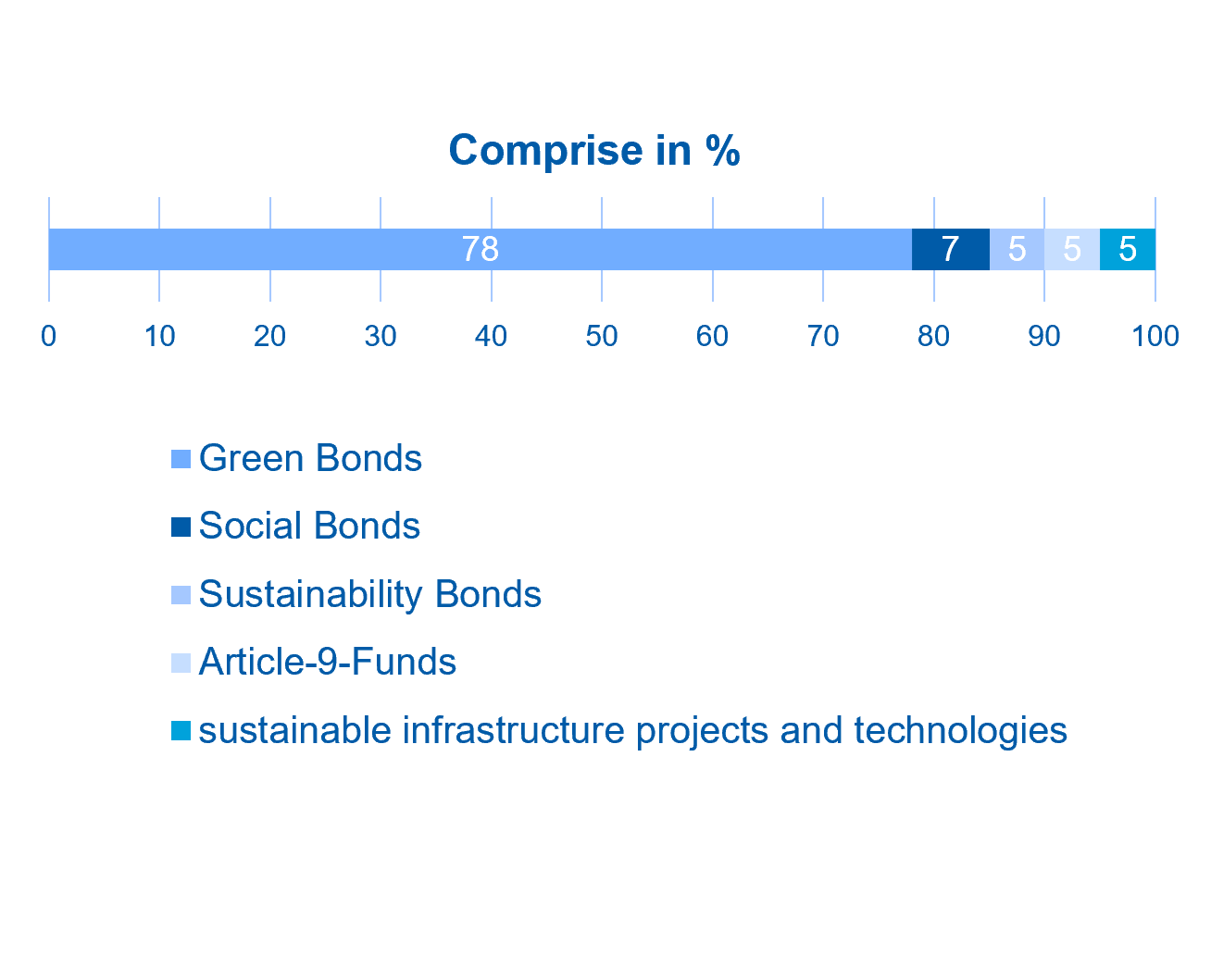

In 2024, the share of sustainable investments in the overall portfolio was 11 % and, as can be seen in the chart, is broken down as follows:

Statement by UNIQA Capital Markets GmbH on the Principle Adverse Sustainability Impacts of investment decisions according to Art 4 SFDR (EU 2019/2088)

According to the EU Disclosure Regulation Art. 4 SFDR, financial market participants are obliged to publish

- a report on the impact of principal adverse impacts on sustainability factors and

- a statement on due diligence strategies in relation to these impacts.

UNIQA Capital Markets GmbH is the internal financial service provider of the UNIQA Group, due to the lack of its own homepage, the report is published on the homepage of the UNIQA Group.

VÖNIX

The VÖNIX (VBV Austrian Sustainability Index) is an Austrian sustainability index that includes companies listed on the Vienna Stock Exchange that are leaders in social and ecological criteria. The index was introduced in 2005 and is reconstituted annually based on a comprehensive analysis. The UNIQA Group is part of this index and was rated with a ba in the indicative rating, corresponding to a score of 1.7.