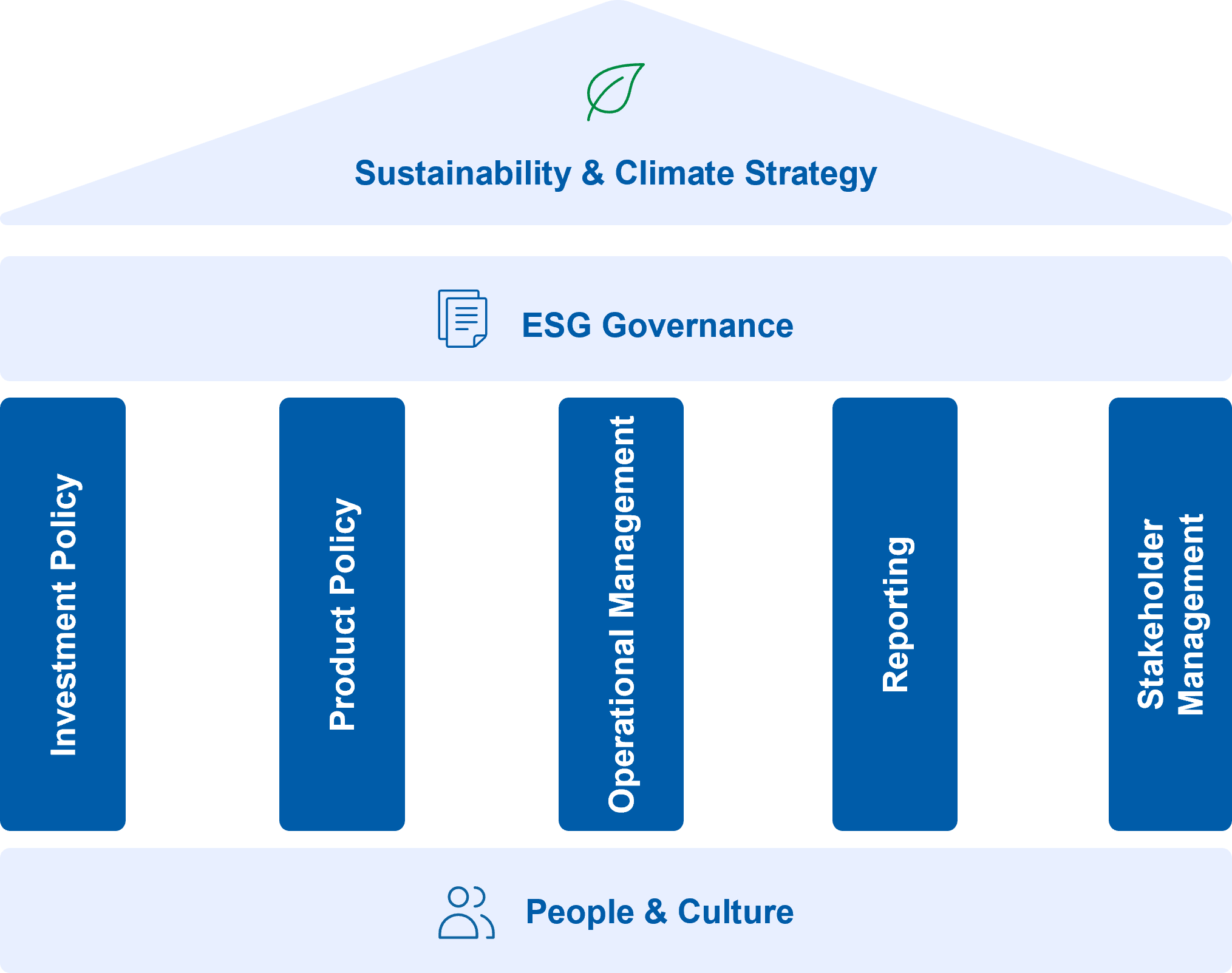

Strategy & ESG Governance

We carefully consider the conditions we believe are conductive to a better life. To do this, we engage in discourse, share our views and commit to making sustainability a central part of our core business. Our clear stance generates understanding and support from all our stakeholders – employees, customers, investors and the public.

Sustainability Strategy

The UNIQA Group sustainability strategy pursues a holistic approach and combines its economic endeavours with a clear ecological and social commitment to the environment and society. We are constantly refining our sustainability strategy and aligning our goals and measures even more closely with established international and national frameworks.

The five cornerstones of our sustainability strategy are:

1. Investment policy based on ESG criteria

Investments constitute an integral part of our activities. The assessment of environmental and social impacts on our assets on an ongoing basis (“outside-in”) as well as the assessment of the ecological and social impact of our investments (“inside-out”) are incorporated into the structure and management of the UNIQA portfolio. The latter point also includes indirect CO2 emissions. Calculated on the basis of transparent and standardised data and corresponding databases. UNIQA is a member of prestigious networks such as the Principles for Responsible Investments (PRI) led by the UNEP Finance Initiative and the UN Global Compact, the Net-Zero Asset Owner Alliance (NZAOA), and Climate Action 100+, which support the company’s commitment to greater sustainability in investment. The climate targets for the investment portfolio are based on the 1.5°C limit pathway agreed at the Paris Climate Conference and have been successfully validated as interim climate targets by the Science Based Targets initiative (SBTi).

2. Product policy aligned with ESG criteria featuring sustainable additional benefits

Environmental and social impacts are being integrated into the advisory approach at an increasing rate in order to improve both risk prevention and mitigation. Inclusion of these impacts has also necessitated certain product updates. One target in this regard is to offer additional investment opportunities in the life insurance business, with a particular focus on sustainability-orientated products in relation to unit-linked insurance products. Another target is to gradually expand the range of health and property insurance products to promote a sustainable lifestyle and sustainable corporate governance on a broad basis. Supplementary product modules as well as improved consulting quality will also contribute to resource efficiency and bringing down emissions.

3. Focus on sustainable operational management

The UNIQA sustainability efforts aim to inspire its customers to act in a more environmentally friendly and socially responsible way. Attention is paid to the application of international certifications and standards in all of the company’s activities including in its dealing with suppliers. UNIQA aims to set a good example, particularly with regard to climate targets, and to consistently implement its commitment to continuously reduce carbon [MZ2] emissions in its own operational management. The climate target for our own operations are based on the 1.5°C limit set in the Paris agreement. The interim targets for 2030 have been validated by the SBTi.

4. Transparent reporting and ongoing independent ratings

UNIQA provides comprehensive, timely and transparent information on its targets and progress with their implementation. Alongside existing reporting processes, this also takes place on the basis of guidelines that arise from the company’s membership of ESG networks and its support for various initiatives. In addition to improving transparency regarding reporting, a dialogue with ESG rating agencies is also actively sought. UNIQA strives to continuously improve its ESG ratings through additional ESG disclosures.

5. Committed stakeholder management for greater social and environmental responsibility

Our management approach includes maintaining an ongoing dialogue with all key stakeholders and their representatives. The key partners in the stakeholder dialogue are as follows:

- Customers and their interest groups,

- Representatives of the general public,

- Employees and

- Investors.

ESG Integration

We are committed to taking ESG (environmental, social and governance) factors into account for both our insurance and investment business. Sustainability measures only develop their transformative power if they are implemented transparently and verifiably. Within the UNIQA Group, we fulfill this requirement through strong governance, clear responsibilities, well-founded stakeholder engagement and comprehensive reporting & ratings from renowned agencies.

In addition to the involvement of the Supervisory Board and comprehensive Sustainability Management in the Group's internal ESG Office, the Group ESG Committee is a central body.

Sustainability Management

The Group ESG-Office is responsible for coordinating the UNIQA Group's sustainability agendas and reports to the Management Board member responsible for People, Brand, Sustainability, Personal Lines & Asset Management who also chairs the ESG Committee.

The Group ESG Office supports all operating units in setting targets relating to material impacts, risks and opportunities within the business processes. Sustainability is also integrated into topic-specific policies, standards and governance structures in the group functions.

Group Finance prepares the consolidated notes to the consolidated financial statements, including the Group Management Report, and ensures that non-financial information is consistent with the financial information. Group Finance reports to the management Board member responsible for Finance & Risk Management.

The Group companies have ESG experts who deal with the operational and specialised development and implementation of content and measures. In the international business units, strategic ESG Coordinators were integrated into the local organisational structure and governance in all countries and regions of the UNIQA Group in 2023.

Group ESG Committee

The ongoing monitoring of impacts, risks and opportunities takes place via the Group ESG Committee, which is made up of five members of the Management Board and the heads of the Corporate Business and Group ESG Office. The Group ESG Committee meets quarterly and is responsible for ESG integration in the core business. Its most important tasks include

The Group ESG Committee meets on a quarterly basis. Its most important functions include the following:

- Strategic definition and continuous development of Group-wide ESG ambitions.

- Ongoing monitoring of stakeholder awareness of environmental and social impacts and setting topics for the focus of stakeholder dialogue.

- Adoption of the materiality analysis and discussion of material impacts, opportunities and risks.

- Monitoring the Group-wide climate strategy and environmental management and material impacts, risks and opportunities

You can find more details here:

Decarbonisation

Back in 2018, UNIQA was the first Austrian insurance group to initiate a gradual exit from the coal-based business and defined a forward-looking strategy with the UNIQA decarbonisation guideline. We are gradually phasing out fossil fuels in all core business areas.

In addition, UNIQA is supporting existing customers - under certain conditions - who want to exit the coal business.